How to pay property taxes in Turkey?

A buyer of Turkish property is liable for paying property taxes in Turkey starting from the year following the ownership of the property (by receiving Tapu). These can be paid at the council or online in two installments. The charges for the previous years have to be paid by the seller before the transfer of the ownership.

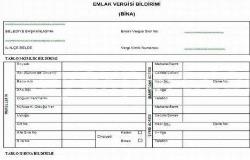

The council is determining the annual tax. It depends on the type of property, registered value, and location. These details are part of the tax declaration (emlak beyani), which every new buyer of a property in Turkey must make within the same calendar year of the purchase.

The tax declaration doesn’t need to be repeated in the coming years as long as there are no changes in the property, ownership, or intended use.

The annual property tax ratios can be seen in the following table:

For example, a homeowner of a residential apartment in Istanbul (a major city) with a registered value of 500,000 TL would pay 0,2% on its value, which is 1,000 TL annually.

As part of our after-sales services, we are helping our clients with their tax declarations for their homes in Turkey. We can follow the yearly property tax payments on their behalf.

Resources

Published on 2019-11-23

Updated on 2021-10-28

Updated on 2021-10-28

Turkish Citizenship

Turkish Citizenship English

English Русский

Русский Türkçe

Türkçe فارسی

فارسی عربي

عربي  Nederlands

Nederlands Deutsch

Deutsch Français

Français Español

Español 中国人

中国人